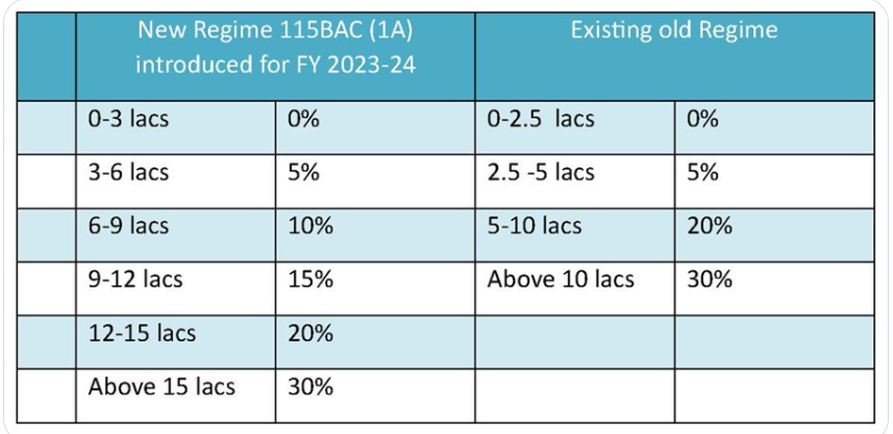

The new tax regime under section 115BAC(1A) was introduced in the Finance Act 2023, as compared to the existing old regime

New tax regime is applicable for persons other than companies and firms, is applicable as a default regime from the Financial Year 2023-24 and the Assessment Year corresponding to this is AY 2024-25.

Under the new tax regime, the tax rates are significantly lower, though the benefit of various exemptions and deductions (other than standard deduction of Rs. 50,000 from salary and Rs. 15,000 from family pension) is not available, as in the old regime.

New tax regime is the default tax regime, however, tax payers can choose the tax regime (old or new) that they think is beneficial to them. Option for opting out from the new tax regime is available till filing of return for the AY 2024-25. Eligible persons without any business income will have the option to choose the regime for each financial year. So, they can choose new tax regime in one financial year and old tax regime in another year and vice versa.

Under the new tax regime, the highest surcharge has been reduced to 25% from 37% for people earning more than Rs 5 crore. This move brings down their tax rate from 42.74% to 39%.

For instance if the individual income during 2023-24 is Rs. 40 Lacs under new regime the tax amount will be Rs. 9 lakhs and under old regime tax amount will be Rs. 10.13 Lakhs (deductions available under old regime). Salaried individual is only having option to choose the regime whether old or new for each financial year.